Venture Capital and Private Equity are loosely correlated with the public market, providing diversification during market volatility.

According to CALPERS, the number of publicly listed companies has declined by 50 percent over the past 20 years, while the number of investors seeking private equity deals has grown.

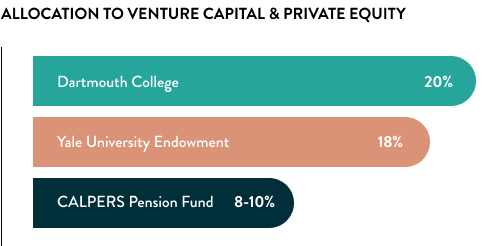

According to Cambridge Associates, many wealthy families, foundations, and endowments have a portion of their portfolios allocated to private investments, with the top decile of those at 40% allocated to private investments.

Portfolio allocations are taken from Investment Policy Statements and/or Portfolio Updates from each institution accessed on July 22, 2019, Yale, Dartmouth, and CALPERS respectively. Cambridge Associates research on portfolio allocation and performance can be accessed in their "Private Investing for Private Investors: Life is better after 40%" report, published on their website in February 2019.