Join us to learn more about the benefits and risks of investing in venture capital, why consumer staples outperform in recessions, groundbreaking technologies for people and planet, and a special in-depth discussion on investing in funds with grant dollars (PRIs) or investment dollars.

Wednesday, April 26, 2:00 PM EST

Thursday, May 4, 1:00 PM EST

The H in our name stands for human and reflects our focus on brands that address timeless, fundamental human needs.

We invest in products you can touch and brands that you find in your home. We are early stage investors in consumer brands.

We are investing in brands that are disrupting billion-dollar categories and changing the way we live our lives.

Leadership of brands over $1 Billion in Global Sales

We are consumer specialists. We have a history of investing early in consumer brands – and leadership of brands over $1 Billion in Global Sales. Collectively, we’ve worked on over one hundred consumer brands representing every major consumer category.

We offer access at a $50,000 minimum investment. We believe that quality venture capital options for individual investors have been limited until now, with high investment minimums at big firms.

85% of consumer purchasing is done by women. 90% of venture investors are men. Morgan Stanley calls this the Trillion Dollar Blindspot. We believe this gives us an advantage.

According to the Federal Reserve, 69% of the US economy is consumer directed, but only 3% of venture dollars are invested in consumer goods and services (Pitchbook). We believe that the relative lack of funding at the early stage in the consumer sector is an opportunity.

In our view, many consumer brands are scaling like tech companies - and have better pathways to liquidity than their tech peers. Changing consumer tastes and a large number of motivated strategic acquirers in the consumer sector are just two reasons why we are focused on the space.

According to Cambridge Associates, venture capital has outperformed the long-term average of major stock indices. According to CALPERS, Private Equity and Venture Capital have been the best returning asset class consistently across 1, 3, 5, 10, and 20 year horizons, with a 6-8% premium over all other asset classes (stocks, bonds, real estate, and others). According to Cambridge Associates, the 30-year annual average for VC returns was 18% - 2x the S&P 500.

Investment period: Venture data is from The Cambridge Associates LLC US Venture Capital Index 2017 and represents total return data. All data is as of December 2017. Venture Capital return data should not be used to estimate the returns of H Venture Partners investments. Venture Capital is a very high-risk, illiquid asset class with a long time horizon.

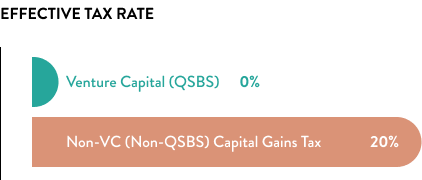

We have typically invested in companies that are under $50MM in assets, which enjoy the favorable tax characteristics of Qualified Small Business Stock (QSBS). According to Section 1202, Gains from selling Qualified Small Business Stock (QSBS) may be eligible for up to 100% exclusion from federal income tax gains of up to $10 million or 10x the tax basis.

Venture Capital and Private Equity are loosely correlated with the public market, providing diversification during market volatility.

According to CALPERS, the number of publicly listed companies has declined by 50 percent over the past 20 years, while the number of investors seeking private equity deals has grown.

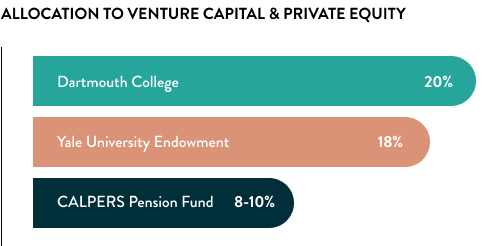

According to Cambridge Associates, many wealthy families, foundations, and endowments have a portion of their portfolios allocated to private investments, with the top decile of those at 40% allocated to private investments.

Portfolio allocations are taken from Investment Policy Statements and/or Portfolio Updates from each institution accessed on July 22, 2019, Yale, Dartmouth, and CALPERS respectively. Cambridge Associates research on portfolio allocation and performance can be accessed in their "Private Investing for Private Investors: Life is better after 40%" report, published on their website in February 2019.